Nace la gestora The Valley Venture Capital, con un primer fondo de 15 millones para invertir en capital semilla.

El objetivo de este fondo es impulsar el crecimiento y el desarrollo de compañías en fase semilla pre-comercial que ofrezcan servicios de software B2B.

La nueva gestora está regulada por la CNMV y cuenta con todo el soporte y experiencia de The Valley.

The Valley, fundado hace 8 años, es un ecosistema de conocimiento digital, colaborativo y abierto, compuesto por la escuela de negocios The Valley Digital Business School; el headhunter especializado en perfiles digitales, The Valley Talent; un espacio colaborativo para startups digitales; un espacio de innovación, The Place, y una consultora de acompañamiento para empresas y profesionales que quieran dar un nuevo rumbo a sus negocios en busca de la disrupción. Con hubs en Madrid, Barcelona, Chile y Colombia, busca el fomentar las sinergias y generar comunidad.

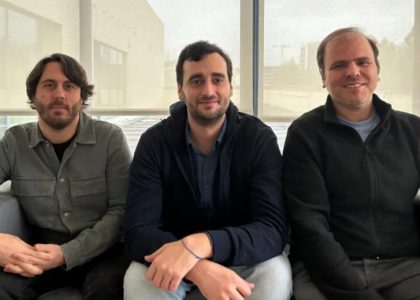

El objetivo de este primer fondo, además de buscar una rentabilidad de alrededor de 3 veces el capital invertido. El equipo gestor lo forman Iñaki Sasiambarrena y Mike Cobián como partners fundadores y líderes de este fondo, junto con un comité de expertos de reconocido prestigio que cubren las áreas de innovación, ciberseguridad, ecommerce, IoT y marketing online. El equipo gestor suma más de 20 años de experiencia tanto en capital riesgo (Baring Private Equity Partners y Ahorro Corporación Desarrollo) como en emprendimiento y venture capital (Bonsai Venture Capital).

La estrategia de inversión del fondo es invertir en los próximos 4 años en 16-18 startups tecnológicas en etapa semilla, con tickets iniciales de entre 200.000-400.000 euros.

El target de inversión es:

● Tipología: compañías fuertemente tecnológicas con alta eficiencia por empleado

● Sector: Prioridad tecnológica valorando otras opciones

● Mercado: B2B y global desde su nacimiento

● Etapa: Semilla pre-comercial

● Sin ventas, pero muy cerca de acceder a etapa comercial

● Equipo: excelente, con experiencia, ya constituido y comprometido. Idealmente con inversión personal en el proyecto

● Modelos de negocio: SaaS, productos digitales y herramientas, Apps

● Geografía: Fundada en España con carácter internacional, especialmente en Latam.

El fondo de inversión The Valley Venture Capital Fund I cerró el pasado 3 de abril su primera operación de inversión, siendo lead investor en la ampliación de capital de Cloudware SL con un importe de 250.000€. Cloudware SL es una start-up tecnológica española que ofrece, a través de su plataforma Nware, un servicio que permite jugar a videojuegos en la nube mediante streaming desde cualquier dispositivo. Actualmente, la plataforma cuenta con más de 10.000 usuarios que diariamente utilizan el servicio desde sus hogares. Con el cierre de esta peración, Cloudware podrá iniciar una nueva etapa centrada en el crecimiento de la plataforma y la mejora de sus tecnologías, entre las que destaca un nuevo algoritmo de codificación de vídeo en tiempo real diseñado específicamente para cloud gaming, que mejorará la latencia, el gran reto tecnológico existente en este sector.